The growth of AI data centers is expected to drive surging demand for capacitors used in servers, with the Japan Electronics and Information Technology Industries Association (JEITA) predicting in its latest report a fourfold increase in demand by 2029 compared to 2023 levels.

According to Nikkei, JEITA predicts that within the next three years, there will be more than 1,000 data centers with power requirements exceeding 10MW. Moreover, computing capacity in 2030 for processing AI and other data will reach 500 times the level seen in 2023.

The massive power consumption in data centers has driven a surge in demand for high-capacity multilayer ceramic capacitors (MLCC). As a result, MLCC makers have seen rising profits from increased demand.

As an example, from April to December 2024, the Japanese component maker Murata saw revenue increase by 7% year-over-year, while operating profit also grew by 9% year-over-year, primarily driven by heightened demand for MLCCs and other components for data centers offering generative AI services.

Furthermore, Murata president Norio Nakajima expects AI server-related revenue to double in fiscal year 2025 (April 2024–March 2025), since AI servers use 5–10 times more MLCCs than communications servers, and at higher unit prices as well.

In addition, analysts at Nomura Securities point to a growth trend for MLCCs due to the proliferation of AI. Price drops for MLCCs and other electronic components have slowed, with some components even showing signs of tight supply, suggesting increased demand for passive components driven by AI.

According to JEITA, capacitors accounted for 34% of the total shipment value of electronic components sold by Japanese manufacturers in 2024. Yet the demand for MLCCs in AI data centers has only just begun: even though AI servers only accounted for 5% of Murata's annual revenue in 2024, this was already roughly triple the amount seen in 2023. Since the data center and AI server segment is expected to see the strongest growth within the next three years, Murata is working to develop smaller products capable of handling higher currents to meet the demand for AI servers.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

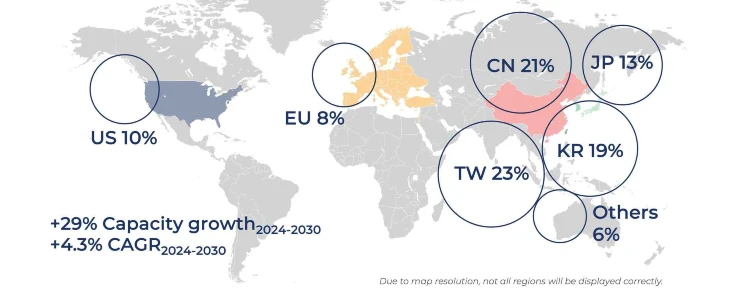

In a sharply bifurcated foundry landscape, TSMC continues to assert dominance, driven by surging AI demand, even as macroeconomic headwinds—including stronger tariffs and a strengthening New Taiwan do

The global semiconductor foundry market is on the verge of a significant structural change, according to Yole Group. In its newly released “Status of the Semiconductor Foundry Industry report,” the an

TI is one of the largest foundational semiconductor manufacturing companies in the U.S., producing analog and embedded processing chips for smartphones, vehicles, data centers, satellites and other el